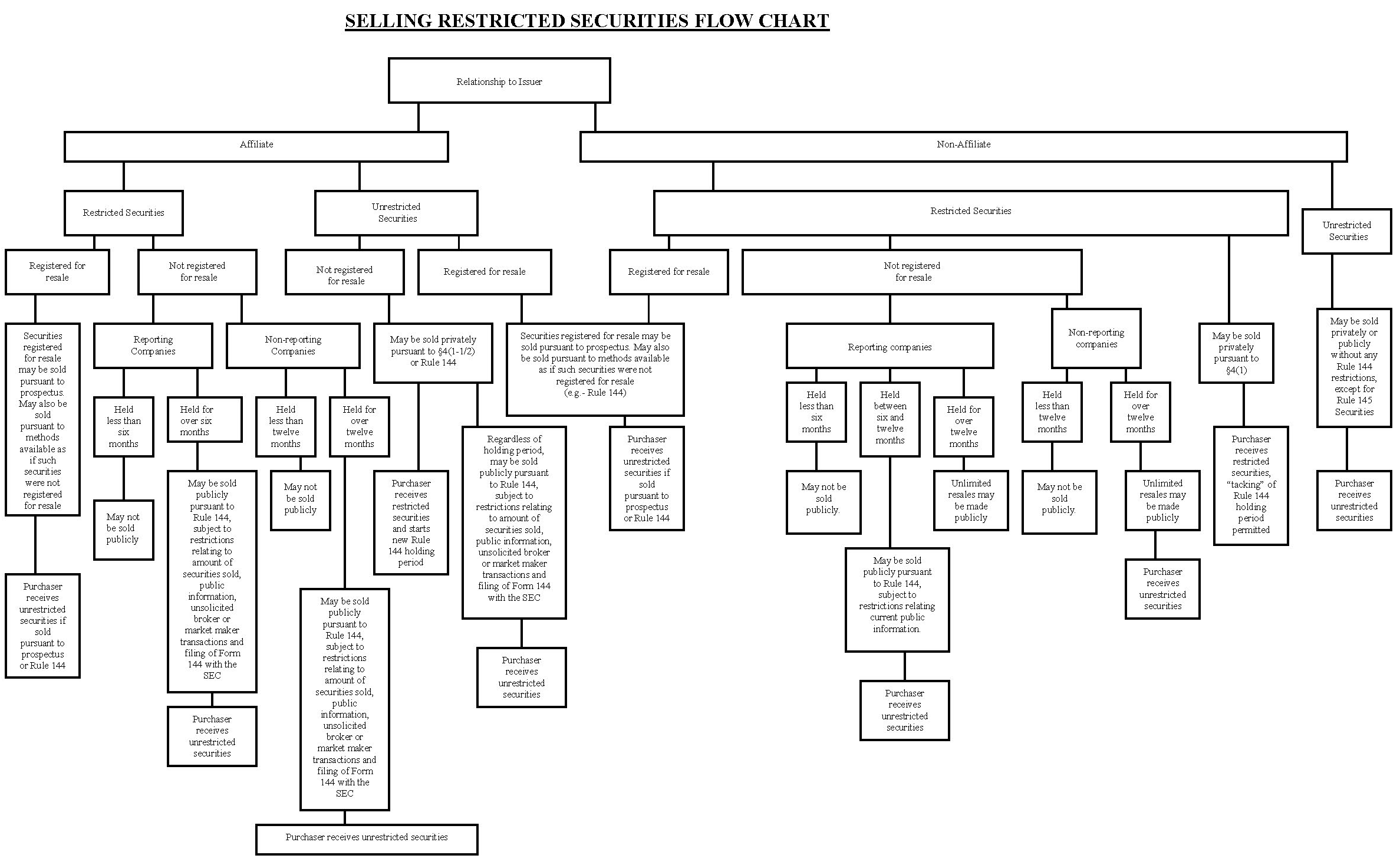

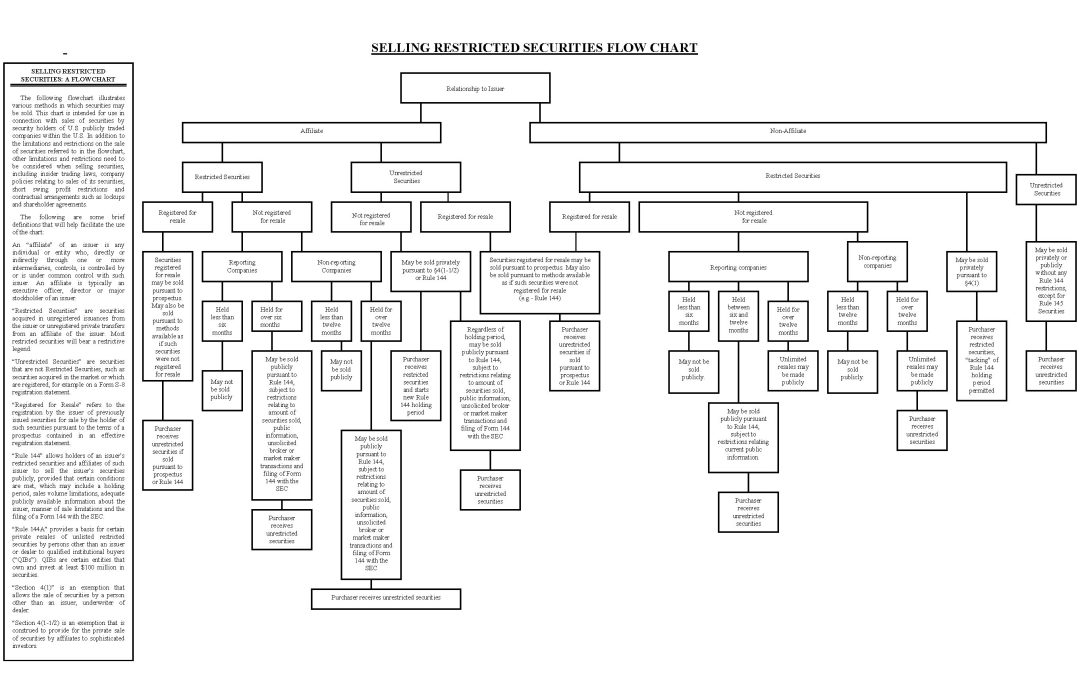

SELLING RESTRICTED SECURITIES: A FLOWCHART

The following flowchart illustrates various methods in which securities may be sold. This chart is intended for use in connection with sales of securities by security holders of U.S. publicly traded companies within the U.S. In addition to the limitations and restrictions on the sale of securities referred to in the flowchart, other limitations and restrictions need to be considered when selling securities, including insider trading laws, company policies relating to sales of its securities, short swing profit restrictions and contractual arrangements such as lockups and shareholder agreements.

The following are some brief definitions that will help facilitate the use of the chart:

An “affiliate” of an issuer is any individual or entity who, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such issuer. An affiliate is typically an executive officer, director or major stockholder of an issuer.

“Restricted Securities” are securities acquired in unregistered issuances from the issuer or unregistered private transfers from an affiliate of the issuer. Most restricted securities will bear a restrictive legend.

“Unrestricted Securities” are securities that are not Restricted Securities, such as securities acquired in the market or which are registered, for example on a Form S-8 registration statement.

“Registered for Resale” refers to the registration by the issuer of previously issued securities for sale by the holder of such securities pursuant to the terms of a prospectus contained in an effective registration statement.

“Rule 144” allows holders of an issuer’s restricted securities and affiliates of such issuer to sell the issuer’s securities publicly, provided that certain conditions are met, which may include a holding period, sales volume limitations, adequate publicly available information about the issuer, manner of sale limitations and the filing of a Form 144 with the SEC.

“Rule 144A” provides a basis for certain private resales of unlisted restricted securities by persons other than an issuer or dealer to qualified institutional buyers (“QIBs”). QIBs are certain entities that own and invest at least $100 million in securities.

“Section 4(1)” is an exemption that allows the sale of securities by a person other than an issuer, underwriter of dealer.

“Section 4(1-1/2) is an exemption that is construed to provide for the private sale of securities by affiliates to sophisticated investors.

Nothing herein constitutes legal advice.

ATTORNEY ADVERTISING.